Taxjar integration is used to cover advanced USA state’s tax calculations, VAT (Europe), GST (Australia), and other countries’ tax. Allow storing these transactions on the TaxJar platform. If you need a complete Tax calculation solution and reporting simply integrate with Tax Jar and you are done. To check more details on TaxJar Sales Tax Calculator check here

TIP! Please note, this integration only offers support for Stripe and PayPal payments.

To do this:

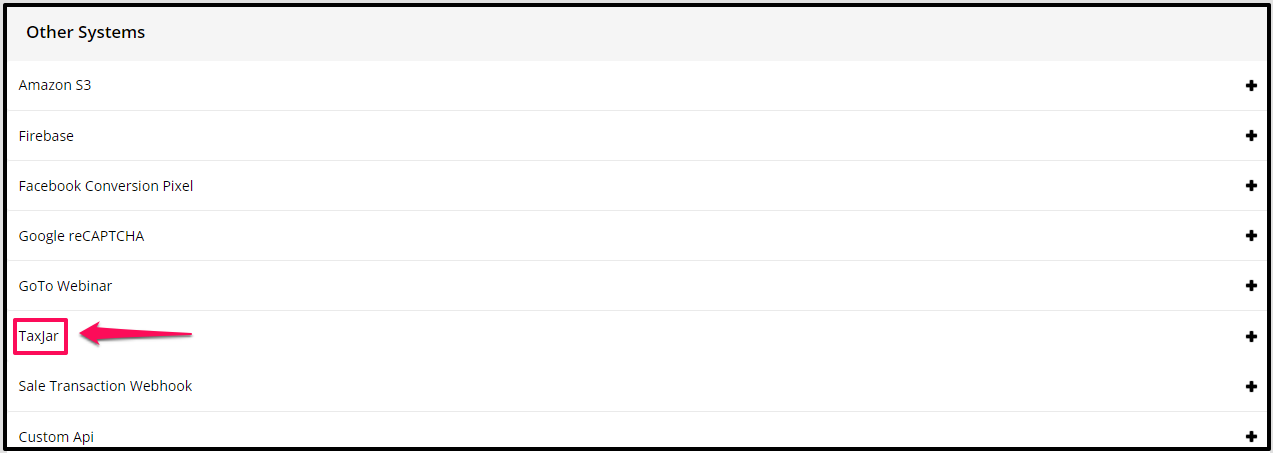

- In your KLEQ site, go to Settings and then select Integrations.

- In the Integrations screen, click on the TaxJar toggle to open the settings section.

- Next, in a new tab, login in to your TaxJar account.

In the top-right corner of the dashboard, click Account > SmartCalcs API. - If you do not have an existing API token, you can generate it instead

Go to SmartCals API located on the left-side panel and click on Generate API Live Token - Copy the Live Token.

- Go back to your KLEQ site.

Paste the Live Token in the SmartCalcs API Token field provided.

- If you want to store your transactions in your TaxJar account, enable Store Transactions.

- Choose the country where your company is located for United States, to be able to calculate state Tax, you need to specify the State and the zip code

- Then click SAVE CHANGES to apply changes.

That’s it! Your site is now integrated with TaxJar.

TIP! Now that you have integrated your site with TaxJar, make sure to enable the tax calculation feature on your order page. Depending on the location of your customer, the VAT tax, GST and US state tax rates will automatically be added to your Order Billing Block, in a separate row and this will use the TaxJar integration for the tax calculation instead.

Related Articles

Enable Tax Calculation on your Order pages

VIDEO – Easily Enable Tax Calculation